It's never too early to start organizing your healthcare documents - and the peace of mind it brings is invaluable! Check out our blog for essential steps to help you get started.

Read MoreIt’s never too early to start planning for the future! Becoming a parent is an amazing experience, but it also brings immense responsibility. Estate planning is a crucial step to ensure that your children are taken care of and your wishes are respected. Check out our blog to learn more about the importance of estate planning for new parents!

Read MoreAn often-overlooked aspect of estate planning that is becoming more and more relevant each day is the handling of your social media, email, and other online accounts.

While we don’t have a true “digital afterlife” as depicted in Amazon’s new show Upload (not yet at least), your online accounts contain a treasure trove of personal information, data, photos and other valuable assets such as digital downloads, reward points, credit vouchers, cash, and cryptocurrency.

Unless you proactively plan for these digital accounts, your online life, after death, might continue indefinitely in ways you didn’t envision - with no one having any power to change it.

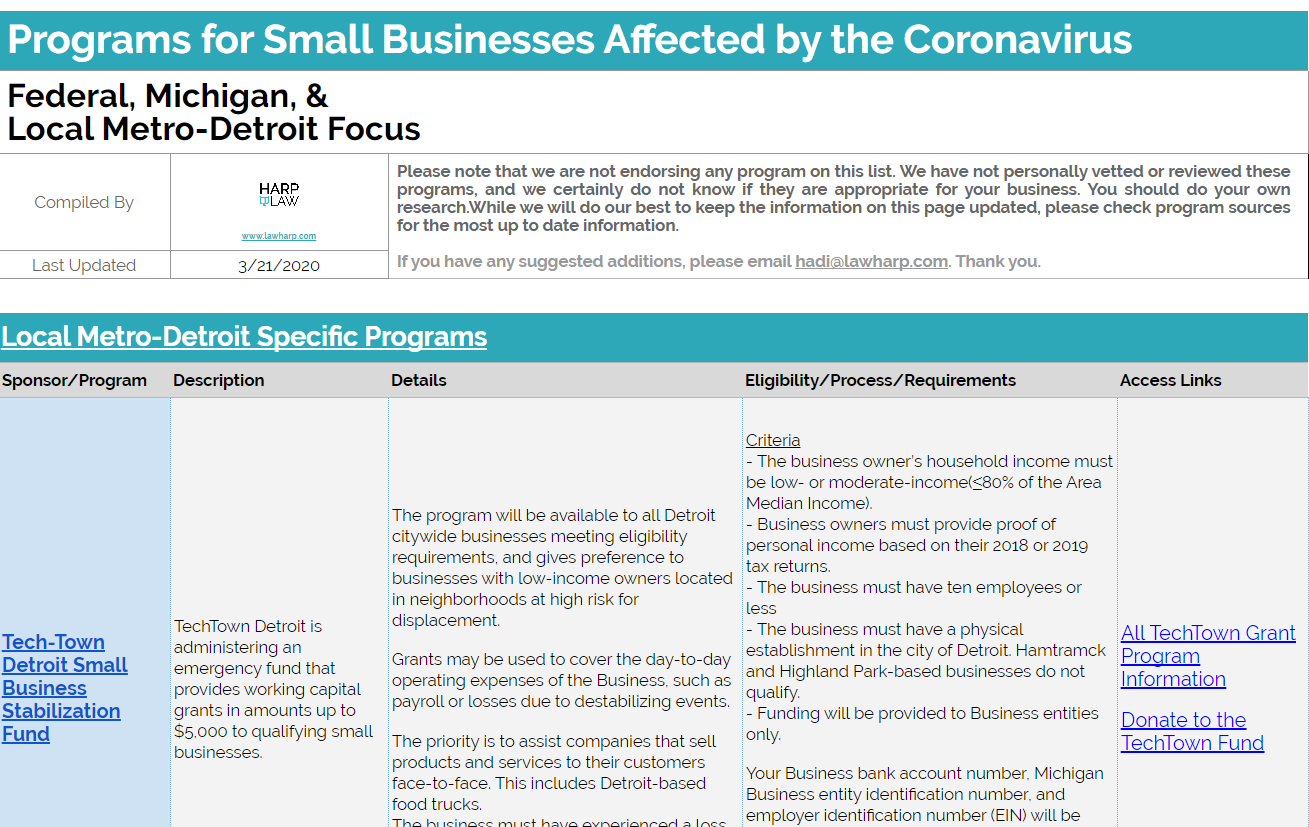

Read MoreThis is a compiled list of all the Federal, Michigan, & Detroit Programs that are available for Small Businesses Affected by the Coronavirus.

Read MoreWith the arrival of the Coronavirus, Detroit small businesses might begin asking very important questions: (1) Do they have to pay for goods or services pursuant to a contract while they are closed? What about rent? (2) Conversely, do they need to deliver on their promise to provide goods or services if they are unable to perform? The answer depends on what your FORCE MAJEURE contract clause says.

Read MoreDon’t take this the wrong way – I hope you and your family stay healthy and safe, but in the event you or a loved one gets sick and needs to go to the hospital or self-quarantine, it is critical that you have a plan in place that addresses certain medical and financial matters.

Read MoreIf you are from Metro Detroit, you have likely already heard of the recent court battles that are being fought over the late Aretha Franklin’s estate. The most recent court appearance featured multiple factions of her family vying for control of the late singer’s substantial estate, which was eventually placed under the supervision of the Oakland County (Michigan) Probate Court.

Read MoreDespite the buzz around smart contracts and the future of commerce, for those currently providing services in the blockchain and cryptocurrency industries, the written contract is still king protocol.

Read MoreAs the New Year rings in, tax season is here once again. For everyone in the crypto world with U.S. tax obligations it means that it’s time again to wrap your head around how to deal with the tax man. In the U.S., everything we know specifically about cryptocurrency and taxes stems from IRS Notice 2014-21. Accordingly, the following is a review of what IRS Notice 2014-21 says with some basic takeaways for getting you on track to accounting for your crypto taxes.

Read MoreCoinbase’s "early" release for support of the August 2017 hard-fork which resulted in the creation of Bitcoin Cash ("BCH") may result in another surprise for those wallets recently credited with BCH: Additional Tax Liability in 2017.

Read MoreAn Employer Identification Number or "EIN" is a nine-digit number assigned to sole proprietors, corporations, partnerships, estates, trusts, and other entities for tax filing and reporting purposes for use in connection with business activities.

Read MoreTrademark law is aimed at preventing consumer confusion and it does this by ensuring names, logos, phrases, and slogans can be distinguished from competitors. On the other hand, copyright law protects the unauthorized use or display of an eligible copyrighted work.

Read MoreSmall claims in California is an informal process to recover monetary damage for claims under $10,000. Attorneys can help you file and prepare for your case in a number of ways.

Read More